Each week, we host top names in DeFi on the CertiK Security Leaderboard Live AMA. The CertiK Security Leaderboard is your one-stop shop for everything security related in DeFi. Head over to CertiK.org and check out the ranking of dozens of projects, their security scores, Skynet statistics, and much more data.

This week, we had the pleasure of talking with Nick Ravanbakhsh, co-founder of Base Protocol. Base Protocol is an elastic-supply token that tracks the total cryptocurrency market capitalization by a factor of one-trillionth, i.e. if the crypto market capitalization is at one trillion dollars, the BASE token targets one dollar.

Nick came on the Security Leaderboard panel to answer some live questions from the audience and give a sneak preview of what’s coming with Base 2.0.

If you missed the stream, don’t worry: here’s a recap of some of what was discussed.

* * * * *

Can you start by giving us an overview of Base Protocol?

Nick: Base Protocol is a rebasing asset. It’s similar to Ampleforth, which is the pioneering and most popular rebasing asset, except Ampleforth is a token which is pegged to the dollar whose supply can dynamically adjust and is elastic, such that a price target can be met. In the case of Ampleforth, that price target is one dollar.

Base takes that rebasing protocol and targets a different price peg. In our case, this is the overall crypto market cap. One-to-one-trillionth. This means that if the overall crypto market cap is one trillion, Base price targets one dollar. If it’s $1.5 trillion, Base targets $1.50, and so forth.

In this way, Base’s goal is to be an index token that people can hold which tracks the performance of the overall crypto market. So that’s how Base has worked since our inception and launch in December.

However, we’ve identified a certain number of challenges with that architecture and have found certain strengths and opportunities in other approaches which we’re exploring now. This is what we’re calling Base 2.0.

You said it’s the total market cap of all crypto. Is there any token that’s excluded?

Nick: Essentially, no. It really is every crypto in the market. The way that data is used is through a Chainlink oracle. We were the co-creator and co-sponsor of that oracle, with Chainlink. If you go to Chainlink’s data feeds, you’ll find an oracle for total crypto market cap.

We were the first to do that with them and the first usecase on that oracle. They’re capturing that data from a number of different sources and nodes. So that’s where we get that total crypto market cap number from.

That makes a lot of sense, and it’s great to see that you’re using a decentralized oracle for that. Staying true to the nature of DeFi.

So in the 2.0 release docs, and again here, you spoke about comparing Base to traditional index funds like the S&P500. Can you share with our viewers why index funds are useful for investors, both in crypto and legacy financial markets?

Nick: As we’ve seen in DeFi, we’re creating a number of innovations that are built on traditional financial institutions and concepts. It’s just taking finance and decentralizing it. The entire idea of earning yields, lending, etc., we’re just seeing that move into a decentralized cryptocurrency space.

And in the same way that we’ve taken those legacy financial models and have been disrupting those, I think one of the bigger core components to legacy finance is the index fund, or index asset model. The S&P500 is one of the most popularly held assets across the entire equities market. And we still haven’t seen any effective cryptocurrency index for a basket of cryptocurrencies that has really taken off.

Base Protocol 1.0 was really the first attempt at that. It was a purely synthetic, algorithmically-pegged asset that wasn’t actually backed by the underlying assets which it seeks to represent. The goal was just for price to peg effectively and based on a number of economic theories and hypotheses the token could eventually act as a proper index to the cryptocurrency market.

We have seen periods where it has, we just think there’s a more effective system where we can actually have the assets backing the token itself. People’s token supply won’t be so susceptible to changes. This is one of the biggest problems we face with Base, and Ampleforth and every other rebasing asset. You have a number of people who buy it for its underlying utility, which in the case of Ampleforth is just to be a dollar-pegged stablecoin, in the case of Base it’s to be this token that tracks the performance of the total crypto market.

While the rebasing protocol is effective in pegging prices, the price chart will relate as it’s supposed to, people’s wallet balances are often in flux in ways that create a lot of confusion in the community.

For sure, I can see that being very worrisome if I opened up my wallet one day and saw significantly less tokens than I expected.

So we’re moving to a different model, whereby — and I guess I’ll just start introducing it — there’s going to be a two token ecosystem: BASE and BIT. BIT is going to be more for the speculators, that’s really where the reward vector is for BASE holders. They’ll basically stake their BASE for BIT, I’ll go into detail on that later.

BASE itself, the other side of that ecosystem, is now going to be a supply-stable token. The price ideally will track the overall crypto market. That’s going to be the native token to the ecosystem, we’re looking forward to more effective market-performance tracking. And then there’s going to be BIT, where you’re exposed to different kinds of reward vectors, kind of like positive rebases.

What security measures do you take to keep your funds safe?

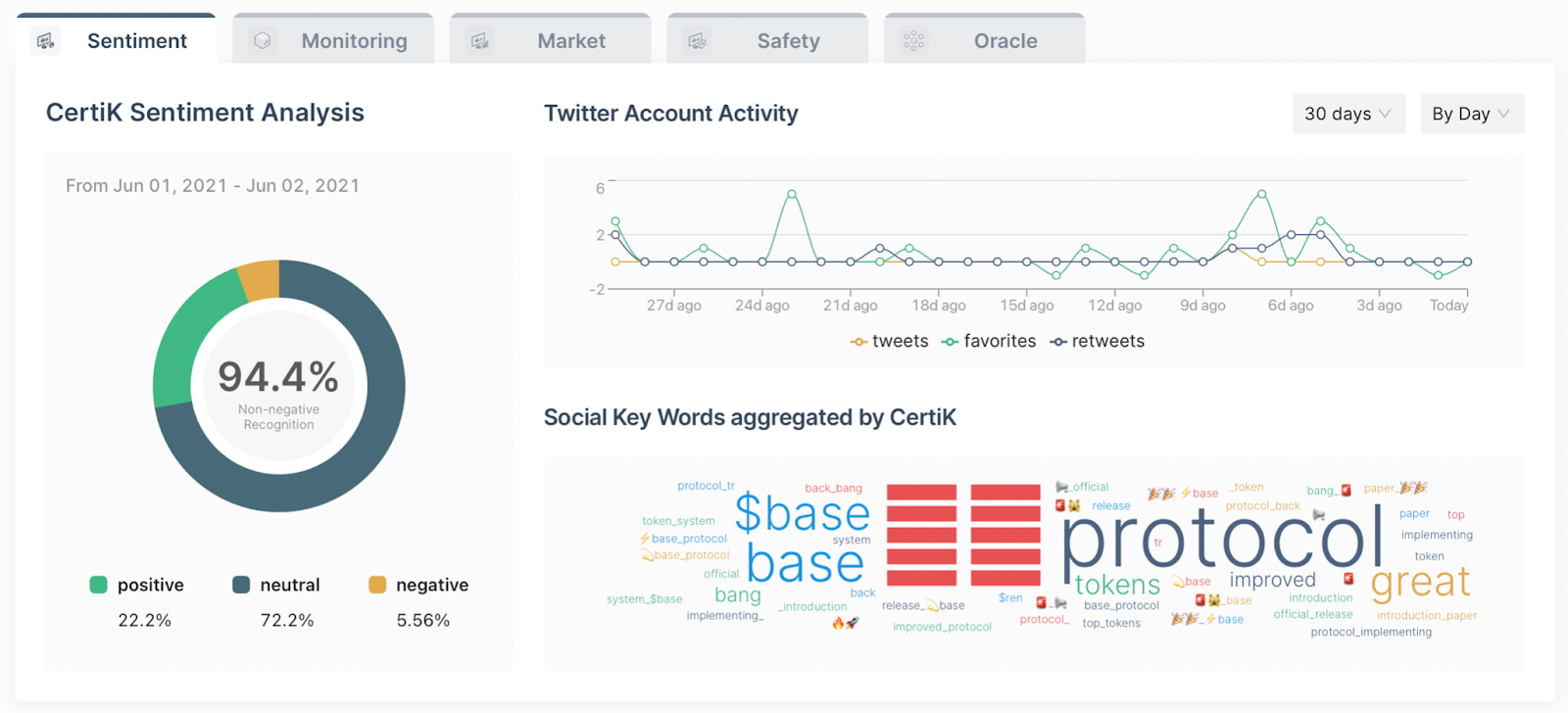

Nick: Most importantly, I’d say CertiK audits and CertiKShield are major factors. We just want to make sure that we’re up to the highest standards when it comes to security on the technical side. We really see CertiK as an industry leader in this space. You guys have a time-tested track record for what you do, and it’s been a really great experience working with you.

I love the profiles you have [on the Security Leaderboard] that really make it easy to DYOR. We look forward to working with you more, especially as we roll out this Base 2.0 stuff.

Why is it better to hold a bag of all cryptocurrencies at once, and not just a small handful you picked?

Nick: When you’re holding them all at once, you guarantee exposure to the performance of all of them, including those ones that you may have otherwise missed out on. So yeah you could just hold some basket of assets that you’ve picked out yourself, but were you there for Bitcoin when it first started? Were you there for Ethereum when it first started? Were you there for Chainlink when it first started? By holding the basket that encompasses really that entire ecosystem of thousands of tokens, you’re guaranteeing that you’ll have exposure to that growth of any emerging projects.

That, as well as the basic case that’s always made that major indexes in traditional finance always outperform people who try to trade themselves. There’s a lot of data on that, and we think that will also be relevant in the crypto market.

Why a one-to-one-trillion peg?

Nick: We think it’s the most elegant and the easiest to explain. Before we hit the one-trillion dollar crypto market threshold, BASE was around $0.50, because the overall crypto market cap was at $500 billion. And now it’s actually gone up to dollar digits, because the market’s in the trillions.

We think it’s pretty, it’s elegant, and most importantly it’s easy to communicate. It’s much easier for me to say the peg is one to the trillionth, rather than one to the ten-trillionth, or one to the hundred billionth. It’s just one to one trillion, that’s what BASE’s peg is.

What are your top priorities in 2021? Can you share some plans for the upcoming year?

Nick: Top priority in 2021 is taking Base 2.0 live on the functional side. And then also the new Base front-end, which we previewed earlier this year. We don’t want to give too many more previews, but Base is having a full branding revamp, and we think you guys are going to love the new UI and UX features. We’re really making some big changes. I’ll sound crazy when I say it, but what we’ve created so far in mockups is the coolest website in cryptocurrency today. So we’re really excited to actually get that out to you guys.

* * * * *

That wrapped up this week’s AMA with Nick from Base Protocol. For more AMA sessions with top DeFi and crypto projects, keep an eye on our social channels and subscribe to our YouTube channel.

🌏 Auditing and Pen-Test Website: https://certik.io/

🌐 Skynet & CertiKShield Website: https://certik.org

🐦 Twitter: https://twitter.com/certik_io

🐦 Twitter: https://twitter.com/certikorg

💻 Github: https://github.com/CertiKProject

📚 Medium: https://medium.com/certik

✉️ Telegram: https://t.me/certikfoundation

This interview has been edited for clarity and concision.